The End of the $800 De Minimis in the U.S.: What It Means for Sellers and Buyers

Disclaimer: This article reflects my personal thoughts, based on publicly available sources and discussions with my friend ChatGPT. It is not official customs advice. For specific cases, please consult a licensed customs broker or trade compliance expert.

📅 Key Dates

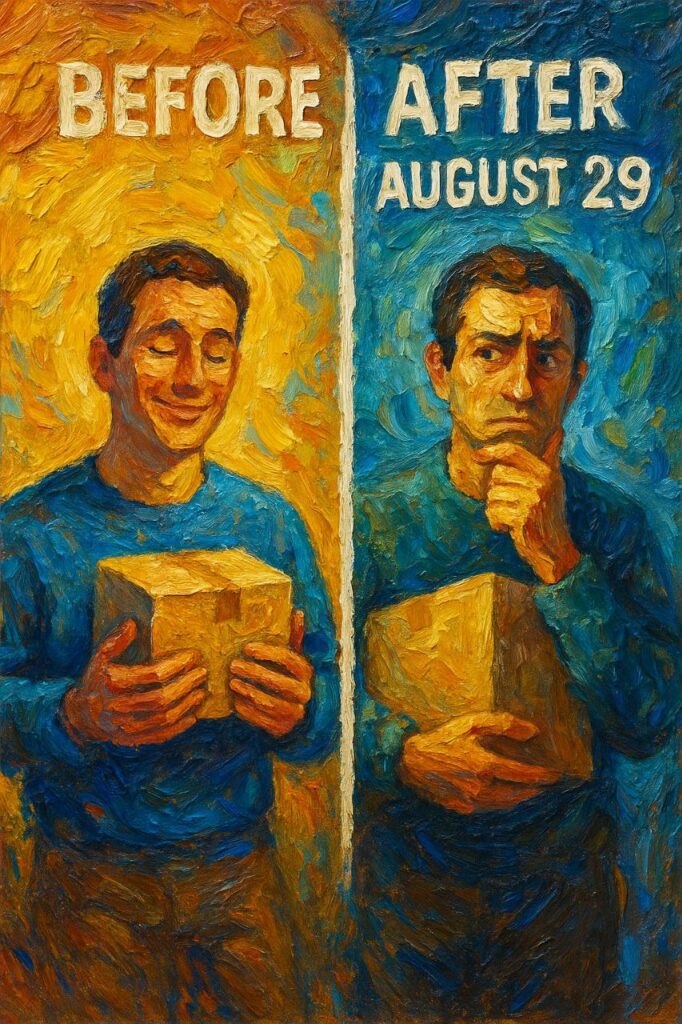

May 2, 2025 — $800 de minimis threshold removed for China and Hong Kong.

August 29, 2025 — $800 threshold removed for all countries.

Until February 2026 — Transition period: U.S. Customs can apply ad valorem duty rates (%) or a fixed $80 fee for postal shipments.

After February 2026 — Only ad valorem duty rates will apply.

📦 How Duties Will Be Calculated

Carrier Method Notes Example (10% tariff)

Couriers (DHL/FedEx/UPS) % of customs value Predictable, but courier service fees may apply $100 → $10 duty

Postal (USPS, Ukrposhta (Ukraine),(Turkiye) PTT) % of customs value or fixed $80 If tariff <16%, customs may choose $80 instead $100 → either $10 or $80

⚠ Risks for Businesses

- Low-value goods via postal service — risk of paying $80 instead of a small % duty.

- Couriers — transparent duty calculation, but potential extra service/clearance fees.

- Mandatory 10-digit HTS codes for every product line in the shipment.

- Uncertainty during transition — customs may switch between methods unpredictably.

💡 Cost-Saving Strategies

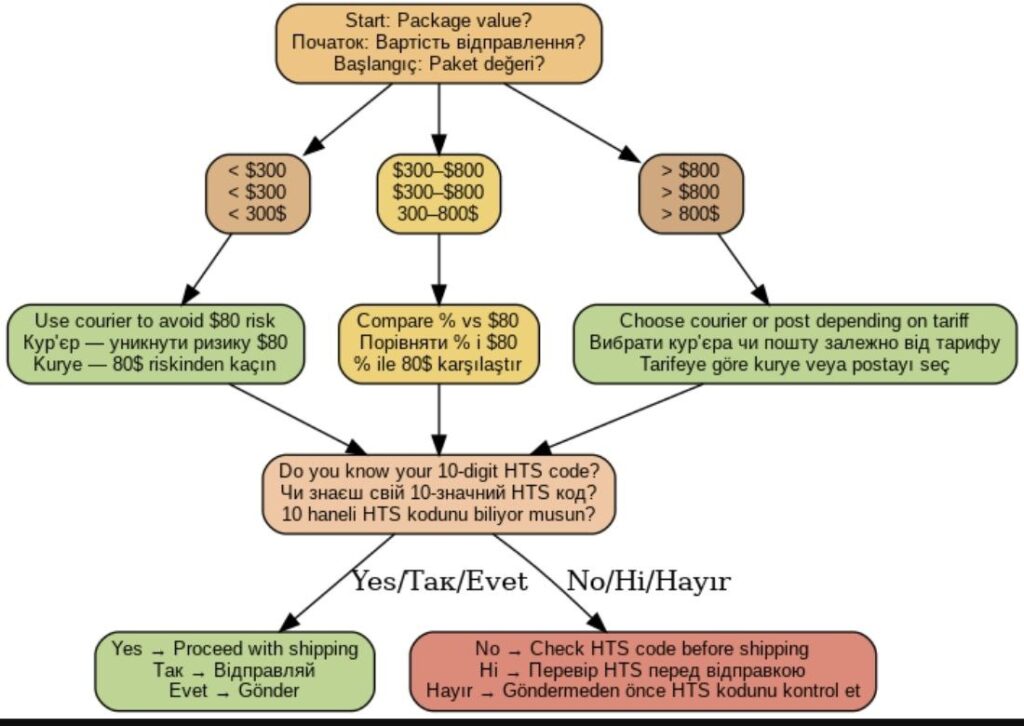

Under $300 — use courier to avoid $80 risk.

$300–$800 — compare both methods; sometimes % is cheaper than $80.

Over $800 — postal can be fine if your tariff is low.

Split shipments — multiple smaller packages can cost less than one large.

Check HTS tariff before shipping.

📊 Visual Flowchart

📚 Sources & Useful Links

Sources

1. The White House – Presidential Actions

Suspending Duty-Free De Minimis Treatment for All Countries

https://www.whitehouse.gov/presidential-actions/2025/07/suspending-duty-free-de-minimis-treatment-for-all-countries/

2. U.S. Customs and Border Protection (CBP)

De Minimis Exemption – Section 321

https://www.cbp.gov/trade/basic-import-export/e-commerce

3. Avalara – Gail Cole, The de minimis exemption is ending: Is your business ready? (July 31, 2025)

https://www.avalara.com/blog/en/north-america/2025/07/de-minimis-exemption-changes-coming.html

4. U.S. Congress – One Big Beautiful Bill Act of 2025

https://www.congress.gov/bill/119th-congress/house-bill/1/text

Disclaimer: This article reflects my personal thoughts, based on publicly available sources and discussions with my friend ChatGPT. It is not official customs advice. For specific cases, please consult a licensed customs broker or trade compliance expert.